Page 8 - On The Move - Volume 16, Issue 3

P. 8

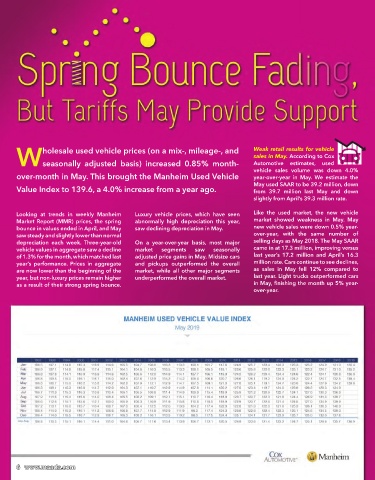

holesale used vehicle prices (on a mix-, mileage-, and Weak retail results for vehicle

sales in May. According to Cox

Wseasonally adjusted basis) increased 0.85% month- Automotive estimates, used

vehicle sales volume was down 4.0%

over-month in May. This brought the Manheim Used Vehicle year-over-year in May. We estimate the

May used SAAR to be 39.2 million, down

Value Index to 139.6, a 4.0% increase from a year ago. from 39.7 million last May and down

slightly from April’s 39.3 million rate.

Looking at trends in weekly Manheim Luxury vehicle prices, which have seen Like the used market, the new vehicle

Market Report (MMR) prices, the spring abnormally high depreciation this year, market showed weakness in May. May

bounce in values ended in April, and May saw declining depreciation in May. new vehicle sales were down 0.5% year-

saw steady and slightly lower than normal over-year, with the same number of

depreciation each week. Three-year-old On a year-over-year basis, most major selling days as May 2018. The May SAAR

vehicle values in aggregate saw a decline market segments saw seasonally came in at 17.3 million, improving versus

of 1.3% for the month, which matched last adjusted price gains in May. Midsize cars last year’s 17.2 million and April’s 16.3

year’s performance. Prices in aggregate and pickups outperformed the overall million rate. Cars continue to see declines,

are now lower than the beginning of the market, while all other major segments as sales in May fell 12% compared to

year, but non-luxury prices remain higher underperformed the overall market. last year. Light trucks outperformed cars

as a result of their strong spring bounce. in May, finishing the month up 5% year-

over-year.

6 www.maada.com