Page 21 - On The Move - Volume 16, Issue 4

P. 21

slightly to 2.0% from the originally reported 2.1%. Consumer

spending was revised up and played a much larger role than

originally estimated as exports, inventories, and residential

investment were revised down. Consumer Confidence, as

measured by the Conference Board, declined modestly in August

by 0.4% to 135.1 from the highest reading so far this year in July.

The percentage of households reporting plans to purchase a

vehicle in the next six months improved to its best level in three

months in August. Purchase intentions remain similar to last year.

Plans to buy a house surprisingly fell in August to the lowest level

in four months but remain similar to last year.

weekend. The August SAAR came in at 17.0 million, increasing

versus last year’s 16.9 million and up slightly from July’s 16.8

million rate. The decline in car sales seems to be bottoming out

as car sales in August fell 1% compared to last year. Market share

for cars was 27% last month. Light trucks outperformed cars in

August, finishing the month up 15% year-over-year.

Strong fleet sales continue to support the new vehicle market.

Combined rental, commercial, and government purchases of

new vehicles were up 23% year-over-year in August. Commercial

(+10%) and rental (+45%) fleet channels were up year-over-year

in August. With the highest average incentive in 20 months, retail

sales of new vehicles were up 9% in August, leading to a retail

SAAR of 14.8 million, down from 14.9 million last August but the

strongest retail SAAR since December. Fleet sales are up 7.3%

in 2019 through August, and retail sales are down 1.3%, as the

overall new vehicle market is up 0.1% this year.

New vehicle inventories came in under 4 million units for the

fourth consecutive month and are at the lowest level since August

2016.

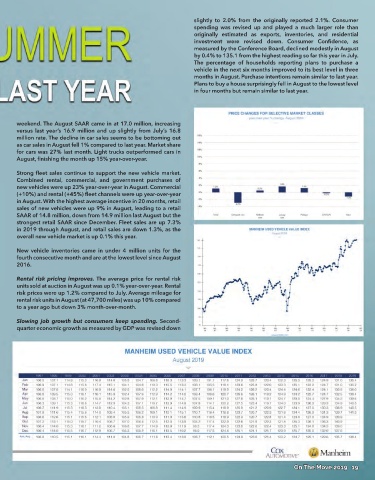

Rental risk pricing improves. The average price for rental risk

units sold at auction in August was up 0.1% year-over-year. Rental

risk prices were up 1.2% compared to July. Average mileage for

rental risk units in August (at 47,700 miles) was up 10% compared

to a year ago but down 3% month-over-month.

Slowing job growth but consumers keep spending. Second-

quarter economic growth as measured by GDP was revised down

On The Move 2019 19